Turn a Fixer-Upper into Your Dream Home

Discover how the FHA 203K Loan lets you buy and renovate with one powerful mortgage.

203K Process

The Catch-22 of Buying a Home That Needs Repairs

Most lenders won’t finance a home until repairs are complete — but you can’t start repairs until you own it. That’s where the FHA 203K Loan comes in.

The FHA 203K Solution

- Finance up to 110% of the after-improved value

- Only 3.5% down payment required

- Roll repair costs into your mortgage

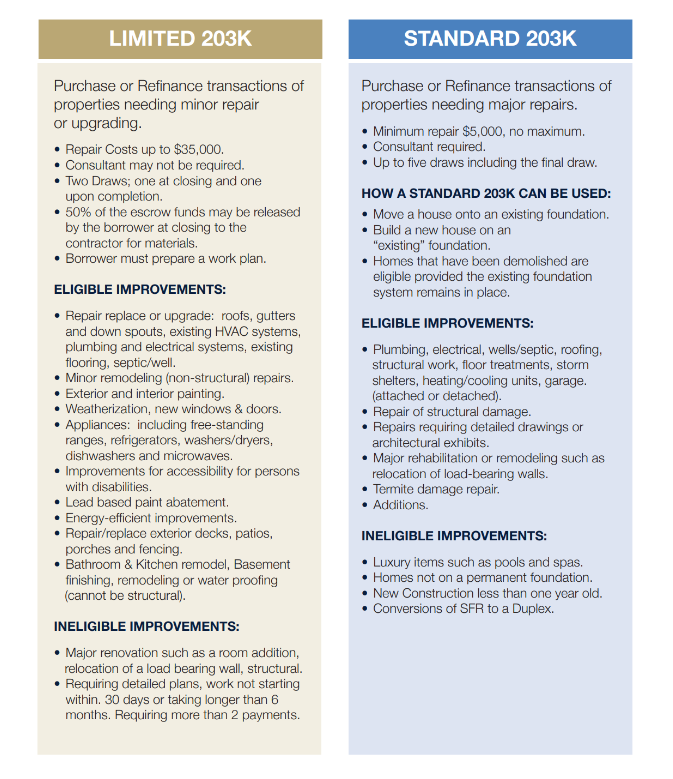

Which 203K Loan Is Right for You?

Feature | 203K Limited | 203K Standard |

|---|---|---|

Repair Scope | Minor repairs (up to $75K) | Major rehab & structural work |

Minimum Repair Cost | None | $5,000 |

Occupancy | Owner-occupied only | Owner-occupied only |

Product Comparison

203K Loan FAQs

IS THE 203K PROGRAM RESTRICTED TO SINGLE-FAMILY DWELLINGS?

No. The program can be used for up to four unit dwellings and condominiums. (Contact lender for specifics related to condos.)

CAN AN INVESTOR USE THE 203K PROGRAM?

No. In October, 1996, the department placed a moratorium on the investor participation in the 203K rehabilitation program.

CAN A DWELLING BE CONVERTED TO PROVIDE ACCESS FOR A DISABLED PERSON?

Yes, a dwelling can be remodeled to improve the kitchen and bath to accommodate wheelchair access. Widened doors and handicap ramps can also be included in the cost of rehabilitation.

WHAT IS THE MINIMUM AMOUNT OF REHABILITATION REQUIRED FOR A STANDARD 203K MORTGAGE?

There is a minimum $5,000 requirement for eligible improvements on the existing structure. Minor or cosmetic repairs alone are unacceptable, but they may be added to the minimum requirement. Under the Limited 203K program, a minimum repair/improvement cost requirement is not applicable.

IS THERE A TIME PERIOD ON THE REHABILITATION CONSTRUCTION PERIOD?

Yes. The rehabilitation loan agreement contains three provisions: work must begin within 30 days of execution, must not cease for more than 30 consecutive days, and must be completed within the time period shown in the agreement (not to exceed 6 months).

WHAT HAPPENS IF THE COST OF THE REHABILITATION INCREASES DURING THE REHABILITATION PERIOD?

No, the 203(k) mortgage amount cannot be increased. This highlights the importance of selecting a contractor who can accurately estimate and complete the work within budget.

CAN MORTGAGE PAYMENTS (PITI) BE INCLUDED IN THE MORTGAGE?

Yes, under the Standard (k) program. Up to six months of payments may be included in the mortgage if the property is not habitable during the rehabilitation period.

CAN COST SAVINGS ON THE REHABILITATION BE GIVEN BACK TO THE BORROWER?

No. Savings may be used for cost overruns or additional improvements. If unused, they must be applied to the mortgage principal. A Change Order must be completed and approved by the lender to use the savings.